Processing Systems

PAYMENT GATEWAYS

Unlocking the Power of Digital Payments

Online Payments

Securely accept major credit and debit cards, and local payment methods on your site.

In-Person Payments

Pay Later & Credit Line

Fraud Detection

The median fraudulent charge has climbed. This equates to about $12 billion in fraudulent charges.

Subscriptions & Memberships

Recurrent Payments

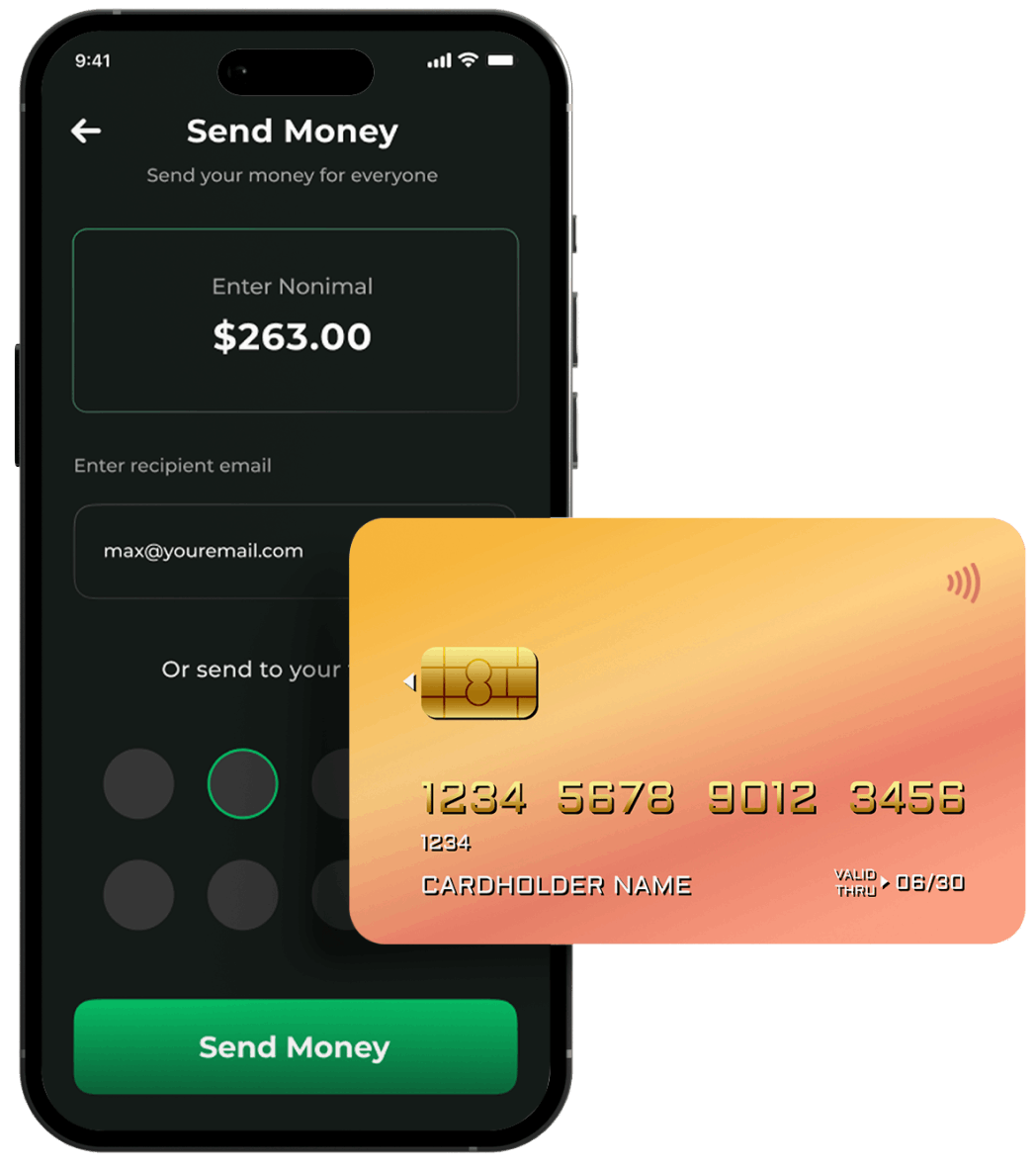

Funds transfer and request

Store Wallet

Debt-free purchases

Pre-orders

Offer your customers the chance to pre-order products before they hit the shelves! Boost sales and create excitement around your store with our convenient pre-order system.

By allowing customers to reserve their desired items ahead of time, you enhance customer satisfaction and gain valuable insights into demand patterns.

Custom Branded

Credit Lines & Credit Cards

Increased purchasing power: By offering store credit lines, retailers extend the purchasing power of their customers. Shoppers can make larger purchases or buy items they might not have been able to afford outright, thus boosting sales for the retailer.

Promotions and rewards: Retailers can offer special promotions or rewards exclusively for customers who use their store credit lines. This helps incentivize shoppers to utilize the credit line, leading to increased sales and customer engagement.

Buy Now

Pay Later

In 2022 are 350 millón BNPL users, and this number is spectated to hit 900 million by 2027.